Free delivery on orders over £50, only £4.95 under £50

Free delivery on orders over £50, only £4.95 under £50

Welcome to our blog, your one-stop resource for news, features and resources for living life to the fullest. View our articles on the latest mobility products and features with disability bloggers.

Posted by Jamie McKay on November 27, 2018

Our handy guide below explains how VAT (Value Added Tax) exemption works, if you can qualify for it, and how to choose it as an option when shopping on our website.

On our website, you may have noticed an option on certain product listings for VAT-exclusive prices but not been fully sure of what that means. Please read the VAT exemption regulations for full details on the current UK VAT laws.

Many items on our website are available to buy VAT-free for customers who live with a long-term disability or chronic condition. This can apply to a product that you are buying for yourself, or for someone else with a relevant disability or condition. VAT exemption is not eligible for customers who have a temporary condition or for individuals who are elderly but still able-bodied - it can only apply to the personal/domestic use of someone with a lifelong disability or chronic condition.

VAT exemption is available on most of our items and usually on more specialist items which aid individuals living with certain conditions. Products that assist with mobility for the long-term, such as wheelchairs and mobility scooters, are eligible for VAT exemption, in addition to smaller items like specialist cutlery to help with arthritis and similar dexterity-related conditions or tremors.

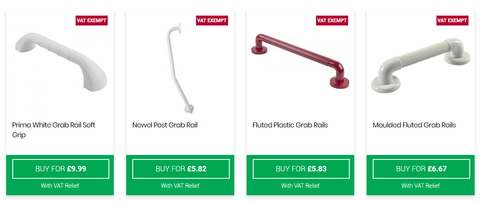

When searching for an item or looking in a category, to see if your desired product is VAT exempt look for:

See image below for example:

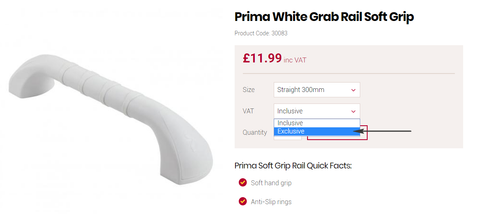

On a specific product page, look for:

See image below for example:

To claim VAT relief on an exempt item, you must choose the “exclusive” option in the box then add the item to the basket. Once this option has been selected, the price above will turn green. For example:

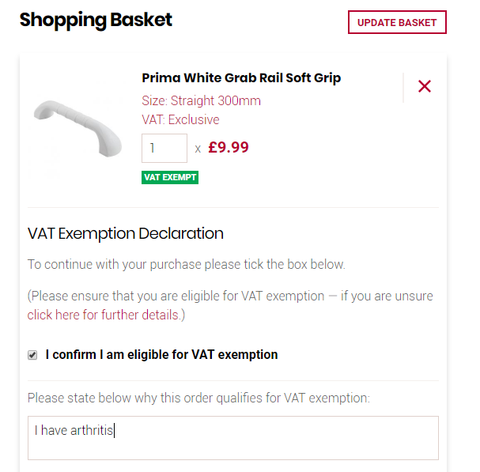

Once the VAT exempt item has been added to your basket and you’re ready to pay, you must declare your eligibility for VAT exemption by clicking on the box which confirms that you can qualify.

Underneath this is a text box, where you state why you or the person you’re buying for qualifies for VAT exemption; all that needs to be entered is what condition or disability you or the person you’re buying for lives with.

For example:

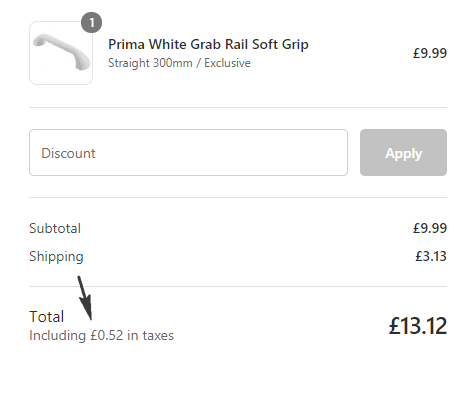

After this, you will then have the option to pay by PayPal or complete the form to pay by debit or credit card and your shipping will be calculated. On items less than £30 in value where postage is not free, the VAT on postage is still required, as seen below: